cash advance near

When Must i Refinance my personal Car loan?

Refinancing your car loan can help bring down the month-to-month costs or decrease your interest. Be sure to crunch new amounts before applying in order to find a https://paydayloanalabama.com/columbia/ very good package for your requirements.

The main trailing car loan refinancing is easy: You are taking into an alternative financing to pay off the bill on the established car finance. If you find yourself suffering from a top rate of interest otherwise an unaffordable payment per month, refinancing will be the the answer to interested in best, significantly more favorable conditions.

Refinancing their car loan could help decrease your monthly premiums by lengthening the definition of of your installment. Or this may save a little money as a result of a lowered appeal speed.

You prefer a better interest rate

You might want to consider refinancing if rates possess dropped since you got your newest mortgage or if perhaps their borrowing wellness enjoys improved.

Whether your borrowing health enjoys improved

Their credit ratings was a cause of choosing the car loan rates. If for example the score have left right up since you ordered the automobile, and you can you have made toward-time automobile costs, you can find a much better price, that’ll help you save money into the attention over the longevity of the mortgage.

Lenders are able to use your own FICO Automobile Scores or foot fico scores to aid dictate your own creditworthiness. But no matter which they use, greatest credit scores often means so you’re able to loan providers you are apt to be to repay the loan, so that they can provide you a lesser rate.

Uncertain in case the score possess enhanced? With the Credit Karma, you can aquire the totally free VantageScore step three.0 credit scores out-of TransUnion and Equifax.

When you’re perhaps not under water on your own latest loan

Normally, its simpler to come across a loan provider that will help whenever your car deserves over the remaining mortgage equilibrium.

This new autos can be beat regarding 20% of the completely new really worth into the first year, and normally fifteen% to twenty five% all the next couple of years, based on Carfax. Therefore day is actually of your essence.

Particular lenders won’t also envision refinancing an older vehicles. Investment You to definitely, including, simply refinances loans getting automobile which can be seven years of age otherwise latest.

How tough can it be in order to re-finance?

For every single financial provides many standards. It can be difficult to examine every one of them, but Credit Karma helps you narrow down a number of the solutions.

LendingClub usually refinance an individual vehicles which have under 120,000 miles. But for particular loan providers, all the way down mileage you can expect to suggest most useful costs. Navy Federal Credit Relationship, eg, has the benefit of finance with rates as low as step 1.79% as of , however, just for auto you to definitely haven’t signed seven,500 kilometers or more.

Along with, remember that some lenders will most likely not re-finance financing for the car’s generate otherwise design. Such, if you push a keen Oldsmobile, Daewoo, Saab, Suzuki otherwise Isuzu, you simply can’t qualify for a car or truck home mortgage refinance loan courtesy Funding One to.

You may also will want to look additional your financial to possess financing. Although some lenders, including Financial out of The usa, have a tendency to refinance an existing loan they have considering your, most other lenders wouldn’t.

Does trying to get a car loan apply at my credit scores?

If your bank draws your own credit, your loan app will show up on the credit file given that a difficult query. If you find yourself tough concerns make a difference to their borrowing, each of them may only hit a number of issues of your ratings. And you may doing your research might not hurt – with regards to the borrowing-rating model, one car loan issues that happen contained in this a given date duration anywhere between 14 to forty-five weeks commonly amount because the good unmarried query.

Second tips

In case your borrowing from the bank provides enhanced, interest levels have left down otherwise you’ve found a lender which could possibly offer your best terms and conditions, it would be the full time so you can re-finance. First, be sure to what you should do:

- Confirm your existing monthly obligations, Annual percentage rate plus the duration of the loan.

- Contrast refinance even offers and make certain you know how much you can easily spend inside interest across the lifetime of the loan. An internet auto loan calculator can help.

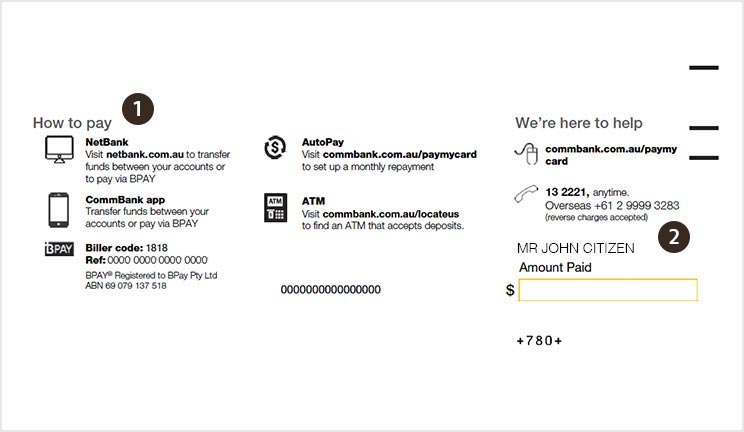

Get in touch with Education Earliest and you will let us crisis new amounts for you. We may you should be in a position to save a little money. Give us a call you from the 614-221-9376 otherwise email address united states at the We are here to aid walk you through the techniques and you can answer any queries you’ve got.