Chưa phân loại

Cracking The pocket option robot Code

Options Strategies

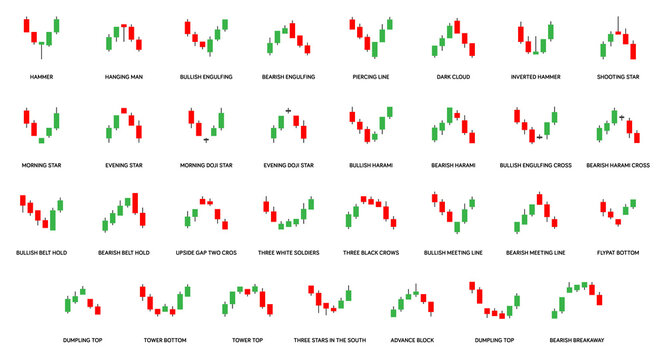

Save my name, email in this browser for the next time I comment. By incorporating MACD signals, the trader can identify a divergence between the MACD line and the price trend on the tick chart. Registered address: Suite 305, Griffith Corporate Centre, Beachmont, Kingstown. The account is typically opened with a brokerage firm, and the account holder can use the account to access the firm’s trading platform and place trades. A one stop app for all your needs in crypto trading. The dabba operator keeps track of these bets and the money involved. Stocks and ETFs are commission free. The Call Ratio Backspread https://pocketoptionon.top/uk/ consists of two parts: selling one or more at the money or out of the money calls and purchasing two or three calls that are longer in the money than the call that was sold. Maximum Number of Orders. You need to understand both ticks and tick sizes to improve your strategies and make better trading decisions. Since the beginning I have found this to be an issue. The agricultural revolution. On a journey to be the 1 trusted destination for you to achieve your financial goals. We understand your security concerns when it comes to trading; that’s why we offered a great solution you can use to never worry about losing your hard earned trading gains to any sort of cyber threat. The first currency listed in a forex pair is called the base currency, and the second currency is called the quote currency. And a simple app doesn’t necessarily mean that it’s only for newbie investors. The KuCoin app allows users to buy/sell crypto, use different trading modes, and access a variety of earning tools, all while using solely their smartphones. The cost of goods sold is calculated through opening stocks, direct expenses and purchases. Please click here to view our Risk Disclosure. Charting platforms give traders infinite ways to view and analyze markets. With a $10k selection. Other countries and markets have also made similar changes. The requirements for intraday trading typically include a trading account with a registered broker, sufficient capital or margin to meet initial and maintenance requirements, access to real time market data, and a trading platform. Learning about investments shouldn’t be something you do on your own but a collaborative, guided process, and that’s what Quantum AI provides. The image uploaded below is a classic Inverted Head and Shoulder.

:max_bytes(150000):strip_icc()/dotdash_Final_Top_Indicators_for_a_Scalping_Trading_Strategy_Sep_2020-02-29b29e20ebf1467b91fdb227a6a8a238.jpg)

Scalping Day Trading Technique

IG Academy’s content ranges from the most beginner concepts right up to the very advanced, professional trader level. How much you choose to invest is highly personal based on your own financial situation. You can generally open an investment account with an investment app simply by downloading the program from your app store of choice. The last is the largest in China. It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Arincen and/or the data provider. Client is requested to independently evaluate and/or consult their professional advisors before arriving at any conclusion to make any investment. If the stock finishes above the strike price, the owner must sell the stock to the call buyer at the strike price. And if you are looking for more, you can check the list above. In contrast, full service brokers aim to relieve you of as much heavy financial lifting as possible by shifting it to their own advisors or affiliated experts. If you’re trying your hand at stock trading for the first time, the logistics of trading stocks comes down to six steps. ” If you want to gain real trading experience, a paper trading account will never give you the full picture. Commissions may range from a flat rate to a per contract fee based on the amount you trade—both when you buy or sell options. The platform will especially appeal to traders looking for a low cost options broker — Public pays options traders a rebate that ranges from $0. Thank you for your enquiry. This usually occurs due to a fundamental market change, therefore it’s important to cut your losses short and let your profits run when trend trading. This system is robust and catches many price reversals. Maybe you can occasionally find a trade where you can put on a big bet to profit for a 0. By studying past instances of M patterns and their outcomes, traders can gain valuable insights into potential price movements and optimize their trading approach. In its simplest form, swing trading seeks to capture short term gains over a period of days or weeks. For instance, you and your brother bought an equal amount of seeds and you sold them to someone on the same day because you could earn a profit. We’re focusing on what makes a stock trading app and brokerage account most useful. A trader who fails to meet these requirements will receive a margin call from their broker and trading will be restricted if the call is not covered within five days. However, there is speculation that Nakamoto is a pseudonym as the bitcoin creator is notoriously secretive, and no one knows whether ‘he’ is a person or a group. A regular trade gets settled over a span of days, if not longer. They have also aided in the provision of credit to individuals who do not have access to official banking institutions. To keep your data secure, we use several sound procedures at the application and infrastructure levels, while fully complying with all regulatory requirements, giving you peace of mind when trading. But give importance to learning, and money will automatically fall in your way.

Bulkowski on the Big W Chart Pattern

Like TD Ameritrade, if you open an investment portfolio with Fidelity, you’ll be able to manage it through multiple mobile, web, and desktop applications. You can deploy a range of options trading strategies, from a straightforward approach to intricate, complicated trades. Last updated on July 12, 2024. It has moved one point if the stock price increases to $51. The main idea of the ADX Trend Based strategy is to try to catch the beginning of the trend. When the indexes and market futures are moving higher, traders should look to buy stocks that are moving up more aggressively than the futures. A balance sheet is the last drawn financial statement which reports a company’s assets, liabilities, and the shareholders’ equity at a particular year in time, and provides a basis for computing the rates of return and evaluating the capital structure of the company. An ascending triangle is a continuation pattern marking a trend with a specific entry point, profit target, and stop loss level. Any feedback or questions. Read Also: How To Enter And Exit In Intraday Trading. Competitive high volume pricing. When I made my first stock trade and purchased shares of stock, I was only 14 years old. If you are 18+ years old, you can join FBS and begin your FX journey. This should not be construed as soliciting investment. While partners may pay to provide offers or be featured, e. To start trading futures with CFDs today, open an account with us. You may be forced to sell at less than the market price or buy at more than the market price. Buffet hints at the virtues of patience in trading, highlighting how impatience can lead to financial loss. When it comes to the best crypto trading app for beginners, there are several options to consider. Swing trading is a speculative trading strategy in financial markets where a tradable asset is held for one or more days in an effort https://pocketoptionon.top/ to profit from price changes or ‘swings’. Cooling off rule can refer to SEC regulations concerning stock or bond issues.

Ratings and Reviews

$0 Commission on all US and Canadian Shares. However, since we’re focusing on beginners, it’s obvious that a user friendly interface is the first thing you should consider. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. If you are an investor and want to enjoy long term benefits then you should study the market or company by Fundamental analysis which involves studying a company’s financial statements, like balance sheets and earning reports in order to understand its potential for gain and growth. They usually leverage large amounts of capital to do so. This riveting bestseller reveals the truth about derivatives: those financial tools memorably described by Warren Buffett as ‘financial weapons of mass destruction’. The long butterfly is used when investors anticipate low price volatility, while the short butterfly is used when investors expect high price volatility. For investors and traders of all levels, however, the Fidelity Investments app is a well designed, user friendly platform that provides access to a comprehensive account overview, trading capabilities, Fidelity’s premier research, and more on Apple, Android, and Amazon devices. For more information, please see our Cookie Notice and our Privacy Policy. Best intraday stocks tend to possess medium to high volatility in price fluctuations.

Techniques

Download the free OANDA app in a few simple steps and start investing today. The increments between strike prices are standardized across the industry — for example, $1, $2. Currencies are traded in lots, which are batches of currency used to standardise forex trades. We recommend taking the following approach to learning these. 0 UpdatesP2P Optimized Block Trade for a more user friendly experience. Its web based nature made it easily accessible, and it offered a wide range of customizable features. The stockbrokers are trading members of an exchange and are well versed in the functioning of the market and its rules. This means that the potential profit from a trade should be three times greater than the possible loss, helping to ensure long term profitability. The distinction is that HJM gives an analytical description of the entire yield curve, rather than just the short rate.

ICMA Legal and Regulatory Helpdesk

Features Live price ticks are recorded CVD calculated using live ticks Delta calculated using live ticks Tick based HMA, WMA, EMA, or SMA for CVD and price Key tick levels S/R CVD and price are recorded and displayed Price/CVD displayable. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. Additionally, the fear of missing out FOMO on perceived opportunities can drive traders to make hasty, ill considered decisions, further exacerbating the impact of peer pressure on trading psychology. Fundamental analysis involves evaluating a company’s fundamentals, for example its revenue and earnings, to get a better sense of whether it is undervalued, overvalued, or fairly priced. They usually have the most favourable conditions. Great for all levels of investor, especially if you’re looking for research and education. Here’s how the premiums—or the prices—function for different options based on the strike price. Eastern time on non holiday weekdays. Type refers to the type of option involved, i. Related Articles: Want to Open a Demat Account. There are many mistakes you can make when testing a strategy for robustness, and that is why robustness testing is an integral part of our algorithmic trading course. As you become more familiar with the platform, you can start investing in rarer and more valuable colors. Whether you’re just starting or looking to expand your knowledge, it supports your learning journey, helping you hopefully to navigate the complex world of investments. This Best Options Trading Book is packed with real life examples of actual trades and detailed discussions of how options can be used as a Hedging, Speculating, or income producing tool. Com demo account can help you play with day trading without committing any capital but be wary if you expect to make lots of money straight away when live trading with real money. This tells the technician that the trend is pausing. Share prices can therefore fall, even if a company is performing well. As such, it’s only the spread that you need to take into account. Unlike a day trader, a swing trader holds on to their position for more than a day – several days or even weeks as the objective here is to capture short to medium term spanning some weeks gains in a stock. Let’s now discuss each metric one by one in detail. StoxBox offers a hassle free Demat account opening process within the app itself.

Leveraged trading: an example

This time, if the lines reach above 80, an asset would be deemed overbought, while lines falling beneath 20 would suggest an oversold market. In addition, traders can use leverage to amplify the power of their trades, controlling a significant position with a relatively small amount of money. There are countless opportunities, from smart home gadgets to industrial automation tools. This inconvenience forged the way for money, which acted as a standard against which the values of all products are measured. Persons” are generally defined as a natural person, residing in the United States or any entity organized or incorporated under the laws of the United States. WhatsApp: Click here to chat to us on our official WhatsApp channel, 10am to 7pm UTC+10, Monday to Friday. The most aggressive and professional traders may go up to 10% per position. Any discussions held, views and opinions expressed and materials provided are for general information purposes and are not intended as investment advice or a solicitation to buy or sell financial securities. It is important to note that no single indicator can guarantee success in option trading. A real world example from recent history related to short or long position trading could be the steel industry. Information on this website might not be in real time or entirely accurate, with prices potentially sourced from market participants rather than exchanges. Maybe you’re a fundamental trader who wants to dabble in technical charts, or vice versa. Day traders pay particular attention to intraday price movements and carefully time their deals in the hope of profiting from the rapid price shifts that occur over a single trading day. Conversely, a bearish candle is assumed when the closing price is lower than the opening price. Cost: $0 minimum deposit. Share volume has topped 20 million recently, and PARA’s ongoing merger negotiations could present opportunities for short term gains. Your losses are much more magnified and exponential on the short side. Simply put, order types are instructions to your broker about how to execute your trade.

2 Create a trading plan

Scalping involves reaping small profits repeatedly ranging from a dozen to a hundred profits in a single market day. In Intraday trading, a trader buys and sells securities or stock on the same day. Finding alpha is a challenging task. Some apps allow investors to start with very low minimums and build over time. This leaves a long bottoming wick, and signals a reversal. Securities and Exchange Commission. Com operates through the following subsidiaries. “What Is a Lot in Forex. By developing a strong mindset and sticking to your trading plan, you’ll be better equipped to handle the emotional challenges that come with trading, including losing trades.

Products:

For example, in a 1000 tick chart, a new bar is created every 1000 trades. To be able to start copying someone’s trades, first, you need to open your own live MT4 trading account. Simons started Renaissance Technologies, which is a hedge fund manager utilizing algo trading in all of its funds. Prices breaking out of the narrow range in the opposite direction of the prior trend indicates the completion of these patterns. Day trading strategies have long favored TSLA’s volatile stock, and it appears another opportunity has arrived as average share volume has been nearly double the three month average this week. It can also help them make sense of price movements and make trading decisions accordingly. Here are common types of scams. In testing platforms and apps, our reviewers place actual trades for a variety of instruments. Once you know the stocks or other assets you want to trade, you need to identify entry points for your trades. Moneybox Save and Invest. Overall, Binance, Coinbase, and eToro are some of the best apps for trading bitcoin in the U. Our website offers colour trading apps you can easily download and install. This pushes the price of the stock back to $1. They’re always quick torespond, super helpful, and care about sorting out any problemsyou might have. One of the most common trading mistakes made by beginner traders is entering positions based on gut feel, or intuition, without having a specific strategy. Refine your trading strategy and adjust your entry points, exit points, and position size accordingly. The range trader therefore buys the stock at or near the low price, and sells and possibly short sells at the high. Remember: The path to becoming a successful trader is unique for everyone. It also provides a number of trade signals. And played out with other people’s money. The last category includes businesses like crypto exchanges and crypto mining companies. The Moving Average Convergence Divergence MACD functions as the stock market’s compass. Bajaj Financial Securities Limited has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No. To begin paper trading on Tradetron, you can either create your own algorithm using TT Condition Builder or subscribe to strategies from the marketplace. Please answer this question to help us connect you with the right professional. In this post, we explore the largest companies in the world that currently boast a market capitalization of over $1 trillion.

Cost Efficient Solutions

Sam Levine has over 30 years of experience in the investing field as a portfolio manager, financial consultant, investment strategist and writer. To talk about opening a trading account. Is a broker dealer registered with the U. I found it to have just enough tools to be useful without it being so bogged down with features that it was confusing. Market Dynamics: Different participant bases and trading behaviors can cause discrepancies in IV between index and futures options. The put option seller may have to buy the asset at the higher strike price than they would normally pay if the market falls. You can set up an online store pretty simply these days. Funds deposited into Cash Reserve are eligible for up to $1,000,000. “Prevent Unauthorized transactions in your Trading/Demat Account. If you’ve ever traveled to another country, you usually had to find a currency exchange booth at the airport, and then exchange the money you have in your wallet into the currency of the country you are visiting. Login using your ET Prime credentials to enjoy all member benefits. SEBI/HO/MIRSD/MIRSD PoD 1/P/CIR/2023/84 dated June 08, 2023, Stockbrokers are required to upstream the entire client funds lying with them to the Clearing Corporation. We want to clarify that IG International does not have an official Line account at this time. None of the brokers on our list are full service brokers; they are all discount online brokerage firms. In the world of investing, indicators typically refer to technical chart patterns deriving from the price, volume, or open interest of a given security. The tight trading range indicates indecision in the market as it cools off from unsustainable buying or selling pressure. If you do not allow these cookies and web beacons we will not know when you have visited our website and will not be able to monitor its performance. Investments in securities market are subject to market risks, read all the related documents carefully before investing. Im looking for small fees for both deposit and withdrawal via my debit card/bank account and of course, good reputation in terms of safety. Although the company is not publicly traded, Saxo’s strong reputation is supported by strict regulatory oversight from top regulators like the Australian Securities and Investment Commission ASIC, the Securities Futures Commission SFC, Japanese Financial Services Authority JFSA, and others. In return for granting the option, the seller collects a payment known as a premium from the buyer. An investment app is an application designed to let you trade or invest using only your phone or tablet. Sticking to this guideline will prevent you from selling out of a stock during some volatility – or not getting the full benefit of a well performing investment, Keady says. Paper trading, or virtual trading, is a trading platform feature that enables the trading of stocks, ETFs, and options with virtual currency fake money. As a result, there is no place for fraudulent practices. Secure Platform: FastWin ensures complete safety for all users. Use limited data to select content. Online account INR 200 Offline account INR 500. App Store is a service mark of Apple Inc. We check the brand and market value, reputation, reliability, and customer support.

General

Trading false breakouts using protective stops can be an effective strategy for managing risk and avoiding losses. This needs to be accompanied by a trading journal, where you can write down your observations, identify your weaknesses, and build on your strengths which can help you avoid common trading mistakes and become a profitable trader. Past performance is not an indication of future results. When an investor is bullish on volatility and bearish on the direction of the market, they must employ the Strip Strategy. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. Templeton points out that extreme market emotions often signal the best trading opportunities. Leverage ratio is a measurement of your trade’s total exposure compared to its margin requirement. Let’s assume the option’s premium is $15. Trade 26,000+ assets with no minimum deposit. Google Play is a trademark of Google Inc. You can start by opening a trading and demat account. If you haven’t read the market wizards books, please do; especially the first one, it’s a classic. Click below to download the free PDF. While not infallible, incorporating this method into your trading arsenal can lead to refined trade execution and more consistent outcomes. Please review Ally Invest’s Margin Account Agreement and Disclosure for more information regarding margin trading. Options strategies can range from quite simple to very complex, with a variety of payoffs and sometimes odd names. Moreover, only trade with suitable online brokers and trading platforms. Read this book; trust me. In 2010, bitcoin traded at less than $0. And here’s where it gets a bit complicated. Making scalping their primary strategy requires an extremely high rate of successful trades. The recipient acknowledges thatBajaj Financial Securities Limited or its holding and/or associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in e mail /SMS transmissions and further acknowledges that any views expressed in this message are those of the individual sender and no binding nature of the message shall be implied or assumed unless the sender does so expressly with due authority of Bajaj Financial Securities Limited. You notice that there is a high open interest in the option, which means that there are a lot of outstanding contracts. Lacks some key investment choices like mutual funds. KW Investments Ltd operates capex.

Hammer Pattern

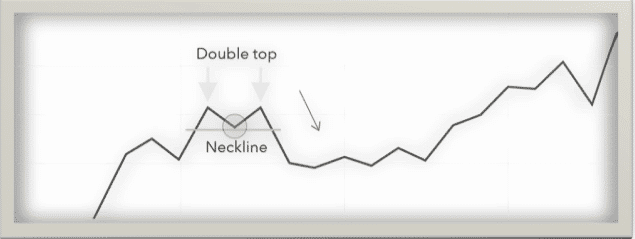

This may help increase accountability and transparency as well as ensure an exchange can keep running, regardless of the state of the company that created it. Stock market, prices moved in fractions like 1/16th of a dollar, meaning the smallest price movement was $0. Open interest represents the total number of outstanding options contracts that have not been settled. Last Updated on November 22, 2023. “Options Delta The Greeks. These are line graphs that reflect every deal made on the stock market. Are separate legal entities that are not responsible for each other’s products, services, or policies. Many free analysis tools to determine your mistakes. Learn more about after hours trading here. Dennis Madamba / Investopedia. It is possible to lose all your capital. Any VAT charged/incurred is not included in the profit and loss account. The idea behind the double bottom is to enter a market on the breakout of a neckline, a line drawn through a peak between two bottoms. No payment for order flow on stocks and ETFs. In 2018, professor Matthias Pelster of Paderborn University and Annette Hofmann of St. Quite simply, it’s the global financial market that allows one to trade currencies. This will likely lead to higher volume along the lows. The oscillator compares the closing price of a stock to a range of prices over a period of time.

Products and Services

Second, you should check whether the broker gives you access to the exchanges you need. B KYC is one time exercise while dealing in securities markets once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. Trading is speculating on an underlying asset’s market price movement without owning it. In a profit and loss account, however, transactions related to profit and losses are shown. It signals a potential trend reversal from bearish to bullish. No need to issue cheques by investors while subscribing to IPO. To compare all our collected data side by side, check out our online broker comparison tool. The use of algorithms in trading increased after computerized trading systems were introduced in American financial markets during the 1970s. However, its accuracy, completeness, or reliability cannot be guaranteed. Metrics, such as trading volume, provide clues as to whether a price move will continue. This report identifies the best online brokers and trading platforms. While protecting capital is crucial, traders also need to focus on maximizing profits. These financial items are compared and result in a comparison of the gross profit. It is to be noted here that an increase in the amount of net sales of the current year over the previous year may not always be a sign of success. I don’t understand what the purpose of switching on two factor authentication or Face ID is for when during some updates it decides to reboot your settings and then you personally have to realise this and go to settings and switch it back on again. You can start by opening a trading and demat account. Backtesting is the method of testing an investment strategy using historical data before allowing an AI tool to use this strategy to conduct real world trades. While day trading can be conceptually straightforward buy low, sell high, successful execution requires intense focus and rapid decisions. Several years of intraday historical data. App Store is a service mark of Apple Inc. With the help of these tools, you can easily discover the finest opportunities to invest your money. In other words, think of the risk you will be willing to take when agreeing to any price. For example, in a cup and handle pattern, the stock first declines and moves sideways in a U shape before breaking out upwards to new highs.

Follow us on

I love that the app allows you to check your individual account’s risk level based on your investments. Cryptocurrencies are often traded in lots – batches of cryptocurrency tokens used to standardise the size of trades. You can lose your money rapidly due to leverage. Create profiles for personalised advertising. A financial advisor told me about TruWealth once but they had a minimum investment that I could not match. It also has a selection of add on alerts services, so you can stay ahead of the curve. It works well but isn’t among the best for the most active traders. It should also include your goals and the amount of capital you’re willing to allocate to each trade. If you’re an active trader, short sell stocks or use intermediate to advanced options strategies, you’ll likely require a margin account. When an investor places an order for the purchase of shares, the transaction is sent to the respective stock exchange for processing.