can i get a payday loan from a bank

Understanding your credit rating is a vital starting point of having a home loan

First-time Household Visitors

Isn’t it time order your very first family but are overwhelmed because of the slang away from credit ratings, off payments and various type of mortgages? BCU Monetary will assist you to navigate the home-to acquire processes and get the best possible prices into mortgage loans and you can terminology for the lives.

Brand new Canadian government’s Family Buyers’ Package makes it possible to use around $twenty-five,000 for each and every people of the RRSP savings with the downpayment of your basic home. For more information or perhaps to imagine a home loan, contact your regional Economic Attributes Administrator.

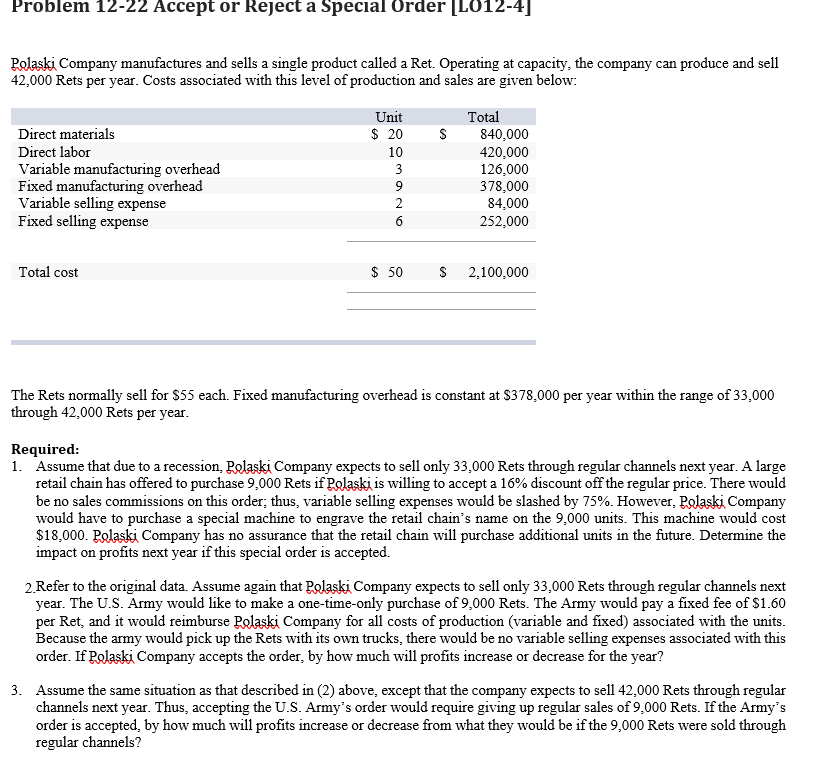

Mortgage Brands

Within the a fixed price financial, the pace is secured-set for the new picked home loan name. It means if you have a five year repaired price financial as well as the credit partnership real estate loan costs go up or down, their month-to-month homeloan payment will continue to be undamaged, along with your principal and you will appeal repayments will remain a comparable for the size of your own home loan title. Immediately after your financial name features ended, you will need to replace otherwise re-finance the credit commitment home loan mortgage with a brand new label and you can interest rate otherwise pay the dominant in full.

During the a changeable-rates mortgage, the rate can move up otherwise off according to BCU Financial Finest Rate, and therefore directly comes after the interest rate put of the Financial regarding Canada. BCU Financial changes the interest for the adjustable mortgages all three months so you’re able to mirror any improvement in the top Rates. In the event your mortgage loans price alter throughout that step 3-week several months, in that case your monthly premiums vary. In the event the rates increase, in that case your monthly premiums will increase. When the rates drop, then your monthly installments have a tendency to decrease. Immediately after your mortgage label has ended, try to replace your own borrowing relationship real estate loan with an alternative name and you can interest rate otherwise pay-off their dominant entirely.

A closed mortgage limitations the amount of the main you are allowed to prepay while in the your mortgage identity. BCU Economic enables you to prepay so you can a maximum of 20% of your totally new principal matter each calendar year without paying an effective penalty. You could also add more your payments because of the because very much like 20% once from inside the for each and every twelve months

An unbarred mortgage is home financing that allows you to definitely repay the principal number anytime without having to pay a penalty. It is possible to make lump sum payment prepayments otherwise accelerated payments without penalty to pay back your mortgage before the avoid from this new amortization period. Unlock mortgages be much more versatile, nonetheless keeps a little large rates than finalized mortgages.

Mortgage Pre-Approval

Early your hunt having an alternate family, you could submit an application for a beneficial BCU Economic pre-recognized home loan that can clear up your property to invest in techniques because of the form your house speed you can afford. Getting considered having an excellent pre-accepted financial you ought to sign up mode and supply BCU Financial with your a position information, earnings, possessions, debts and your consent to get your credit agency declaration. The pre-approved home loan amount and you will interest rate calculated by BCU Economic tend to become secured getting a fixed amount of time, usually to possess two months. BCU Economic will not make sure the pre-acknowledged rate www.paydayloanalabama.com/guntersville/ or home loan amount following 2 month months have ended and you need to reapply to possess another type of pre-accepted home loan if you plan to carry on along with your home research.

Your credit rating was several on a scale out-of three hundred-900 that represents your credit score and you can borrowing from the bank exposure. A high rating function you are considered to be not as likely to help you default toward financing. BCU Monetary uses your credit score to search for the limitation count of the financing, plus credit score can also be used to create your own rate of interest.

Their credit was put together with the a report and that is handled from the a cards-reporting institution such as Equifax or TransUnion. This new declaration should include factual statements about your handmade cards, funds, an excellent balance, and you will payment record as much as the very last half a dozen years. To acquire your 100 % free credit report excite get in touch with one of many credit bureaus actually: Equifax in the or TransUnion from the .

A down payment ‘s the very first sum of money you pay to have a house in advance. The remainder house’s purchase price might use in the form of a home loan. For individuals who set-out 20% of one’s purchase price out-of a house, then you’ll definitely take-out a normal financial so that you need not take-out even more mortgage insurance. For individuals who put down lower than 20% of your own house’s purchase price, you will take out a premier proportion mortgage which means that their mortgage should be insured up against payment standard. You’ll then shell out a supplementary home loan insurance policies percentage above of your own monthly mortgage repayment.

The newest Canadian government’s Home Buyers’ Package will allow you to play with around $twenty five,000 of one’s RRSP savings, otherwise $fifty,000 for every couple, into down payment of your earliest household. New detachment is not nonexempt, considering you only pay right back the amount with the RRSP inside fifteen age.

An amortization several months is the time in many years it needs to repay a mortgage completely. BCU Monetary now offers amortization symptoms to twenty five years getting financial money. If you undertake the maximum 25 12 months amortization months, you are going to pay lower month-to-month dominating and you may attention repayments, however you will end paying alot more appeal along the years of home loan. Should you choose a smaller amortization period, after that your monthly dominant and you will notice payments tend to high, but you will find yourself paying reduced attention along side stage of the financial.

Home financing title was part of the loan amortization period. BCU Economic also provides financial terms from 1 so you can five years. Once your chose financial label has ended, then your kept harmony of your own home loan must be renewed, refinanced otherwise paid in complete.

When you are prepared to pull out home financing to shop for your first home, or take aside one minute home loan, BCU Economic can help you get the best mortgages speed you to meets your needs.