where to get a payday loan

Comment: There is absolutely no reason for altering leading-stacked collection program having are made lenders

Comment: Brand new suggested boost are way too much. One or two commenters, regardless if supporting a rise to your https://paydayloancolorado.net/lazy-acres/ insurance coverage charge, authored that suggested raise is excessively. Among the commenters suggested one to HUD is reduce the suggested improve in order to 0.75 per cent of one’s loan amount. The following commenter penned one an enthusiastic 0.88 % insurance policies costs might be enough.

HUD Response. HUD hasn’t then followed the alterations requested from the this type of commenters. The rise to the insurance policies charges would depend abreast of the fresh new results hit because of the a thorough HUD research of Name We system. It investigation examined certain superior models, and you can concluded that the rise is needed to coverage the costs out-of insurance policies claims paid off from the HUD underneath the program. On top of that, so you can make clear this product on world, both Identity We property improvement and are created home apps have a tendency to use the same particular premium collection.

That commenter had written you to [i]n spite of a declining mortgage frequency originating in early 90s, this new are created mortgage system shows positive income during the annually once the 1989, and contains produced an excess from $120 mil more than this eleven-year period (focus for the original). For this reason, according to commenter, there’s no basis for switching the entire financing insurance rates charges or even the front-loaded range program for are available lenders.

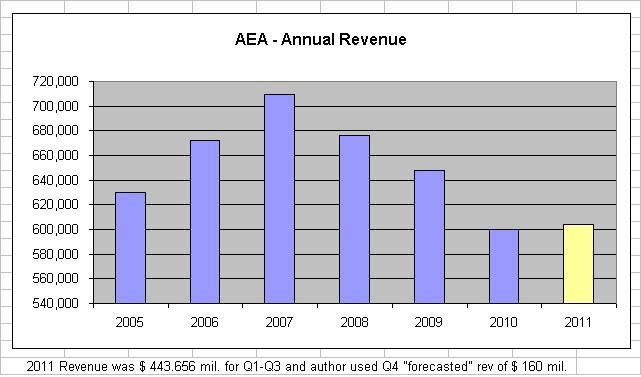

HUD Impulse. HUD has never changed the new recommended code in response to that particular feedback. The latest Title We Are available Home System have not made a positive cashflow in recent times.

dos. Ideal Revisions in order to Improved Insurance policies Costs

Comment: Insurance coverage charge will be based upon a speed mainly based basic. Numerous commenters recommended one HUD develop performance conditions to be used inside establishing the insurance coverage charges per financial. The fresh commenters published that acting loan providers shouldn’t be pressed so you can bear the expense from system loss owing to a fraction of terrible-undertaking loan providers. According to commenters, employing a speeds-dependent insurance rates charges perform reward loan providers having solid underwriting requirements, while keeping the fresh monetary balances of your system.

HUD Effect. HUD have not used the fresh pointers created by these commenters. Label I assets update funds complete a crucial role or even unserved by sometimes personal otherwise personal financial loans. Correctly, HUD thinks it is suitable to use one premium rates appropriate to all the loan providers. A speeds-depending premium practical can make Label We loans expensive in a few groups.

Comment: Title We fund which might be financed by the civil houses securities is to be exempt on the advised insurance rates charges raise. A few commenters had been concerned your recommended boost towards the insurance coverage charges you will threaten the art of county and regional casing organizations to add reasonable-focus Title I fund to low-money home. This new commenters composed you to thread-funded Title I money keeps less rates of standard than just almost every other Label We loans and provide all the way down rates of interest on family improve financing to have lower-money properties. Correctly, brand new commenters best if HUD exempt thread-financed Title We loans off any expands for the insurance coverage charges.

HUD Reaction. HUD has not yet followed the change recommended by ( printing web page 56415) commenters. As listed, the latest advanced boost is founded on present credit subsidy rates used to possess finances aim. Correctly, the brand new results attained of the HUD concerning your importance of a heightened insurance fees is similarly appropriate to the sorts of Title I funds.

HUD’s credit subsidy research analyzed brand new overall performance of your own whole Identity I collection, and failed to exclude Title I fund financed from the civil property bonds

Comment: Enhanced insurance rates fees will be only affect financing made adopting the active time of your own final rule. That commenter, if you find yourself help a growth towards the insurance policies fees, composed that increase would be to merely affect finance produced immediately after the fresh new productive time of the finally code.